Kashoo

Kashoo is a cloud-based accounting platform. It’s based in Vancouver, Canada and is comprised of a small team of 20 people.

The platform is geared towards small businesses but is also an ideal choice for sole-traders/freelancers.

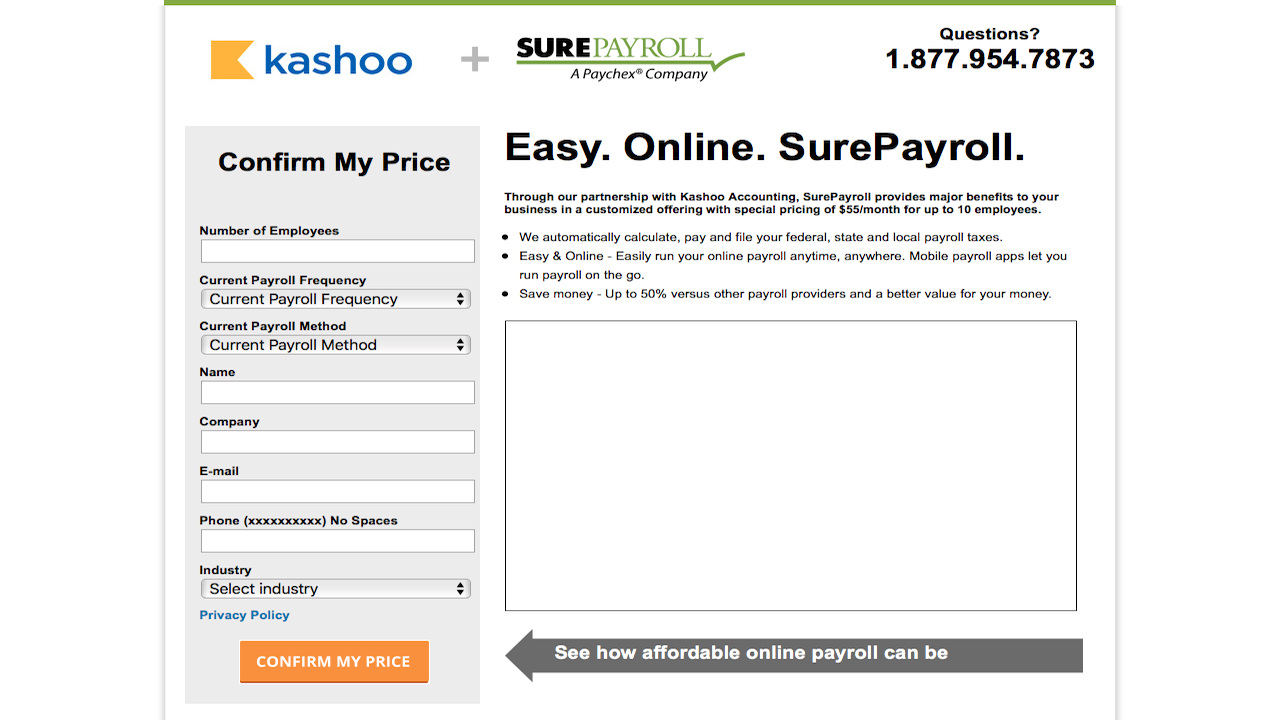

Users can access invoices, generate reports, track bills and expenses. Kashoo offers integration with SurePayroll for an extra monthly price.

It also includes double entry bookkeeping and a mobile app for iPad and iPhone.

- We've also highlighted the best accounting software

Pricing

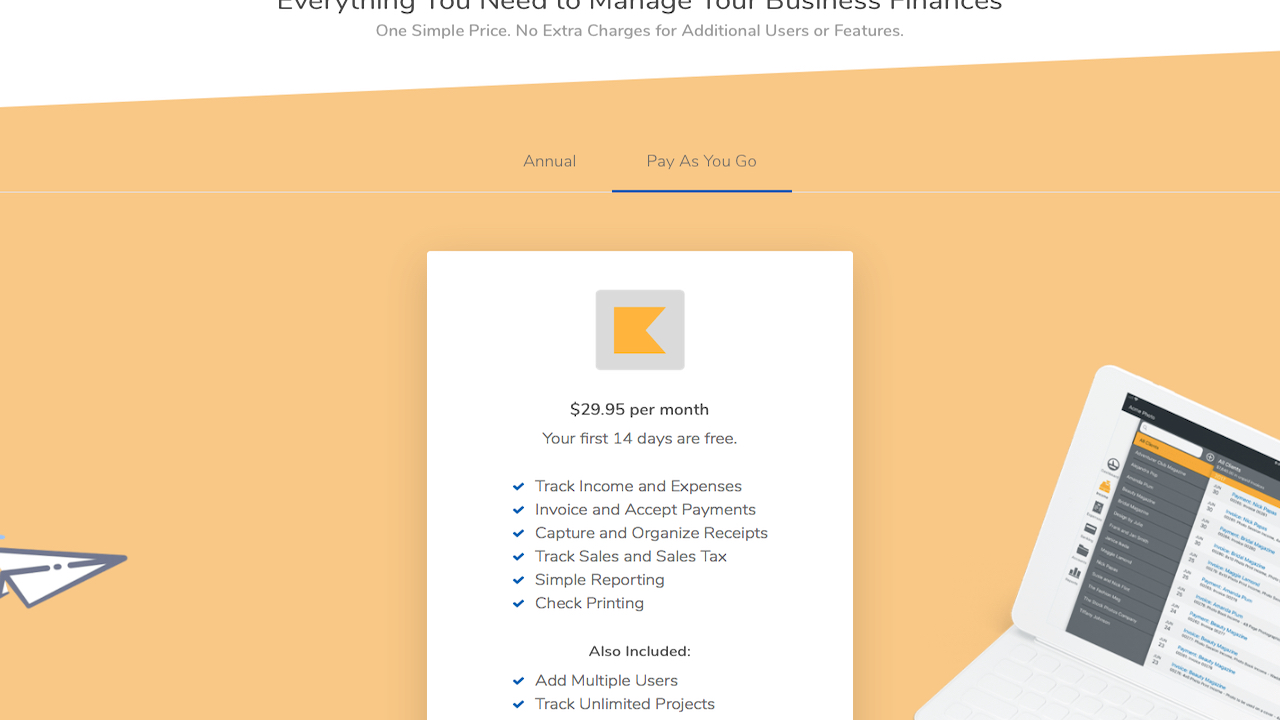

Kashoo offers you the chance to try out their platform for free for 14-days.

You can avail of an annual or a ‘pay as you go’ plan. The annual plan is $199.95 (£155.24), which works out at $16.95 (£13.20) per month. The ‘Pay as you Go’ plan is $29.95 (£23.29) per month.

Both plans include invoices, sales tracking, sales tax, simple reporting, check printing, income and expense tracking. You can also add multiple users, track unlimited projects, manage bills and use multiple currencies.

Setup

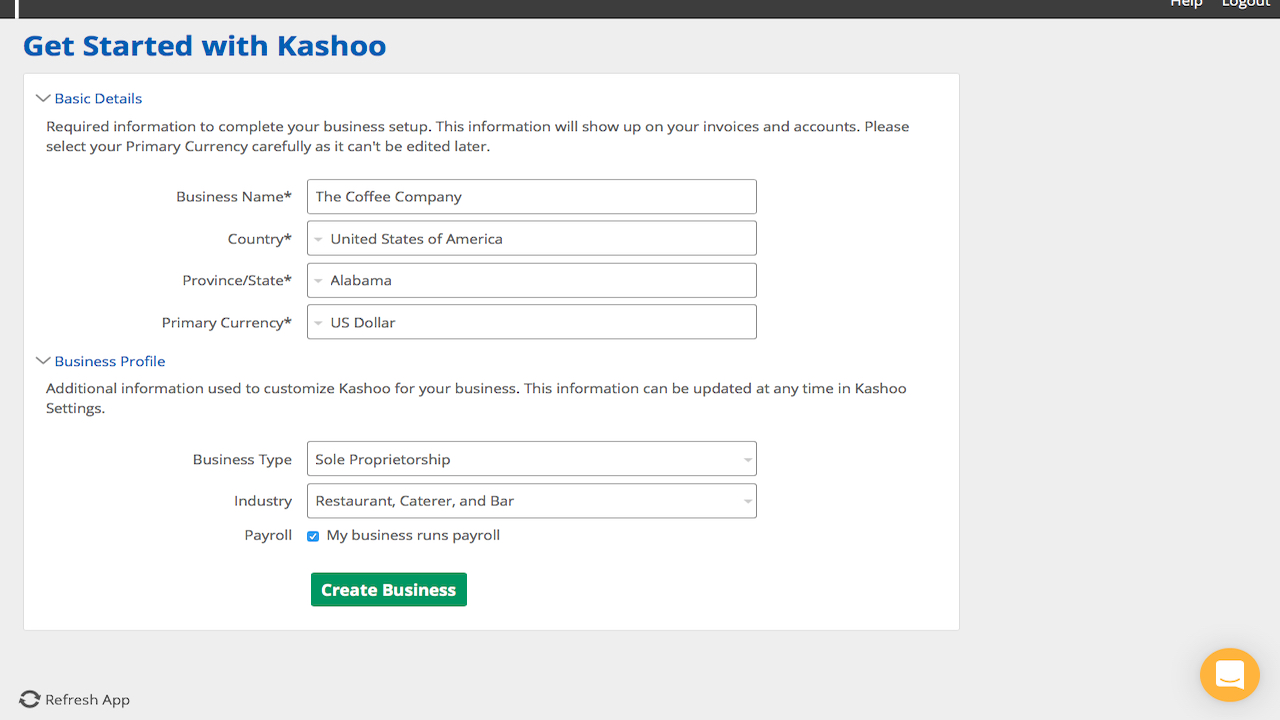

Setup is a straightforward and painless process. You will be asked to enter an email address in order to begin your 14-day free trial. Once this has been verified, you can begin to setup your account.

You need to enter your company name, country, state (if applicable), the type of company you own and which industry you belong to.

As Kashoo is cloud-based, you can use it on any operating system. This also means you won’t have to download any extra software during the setup process.

After registering, you can enter your mailing address, additional business information and any other details applicable to your organization in the ‘Settings’ section at the top right of the screen. You can also set the sales tax applicable to your company and link your bank accounts.

You can then choose to add more users, connect your account to Stripe, BluePay, Square and FreshBooks Classics.

Interface

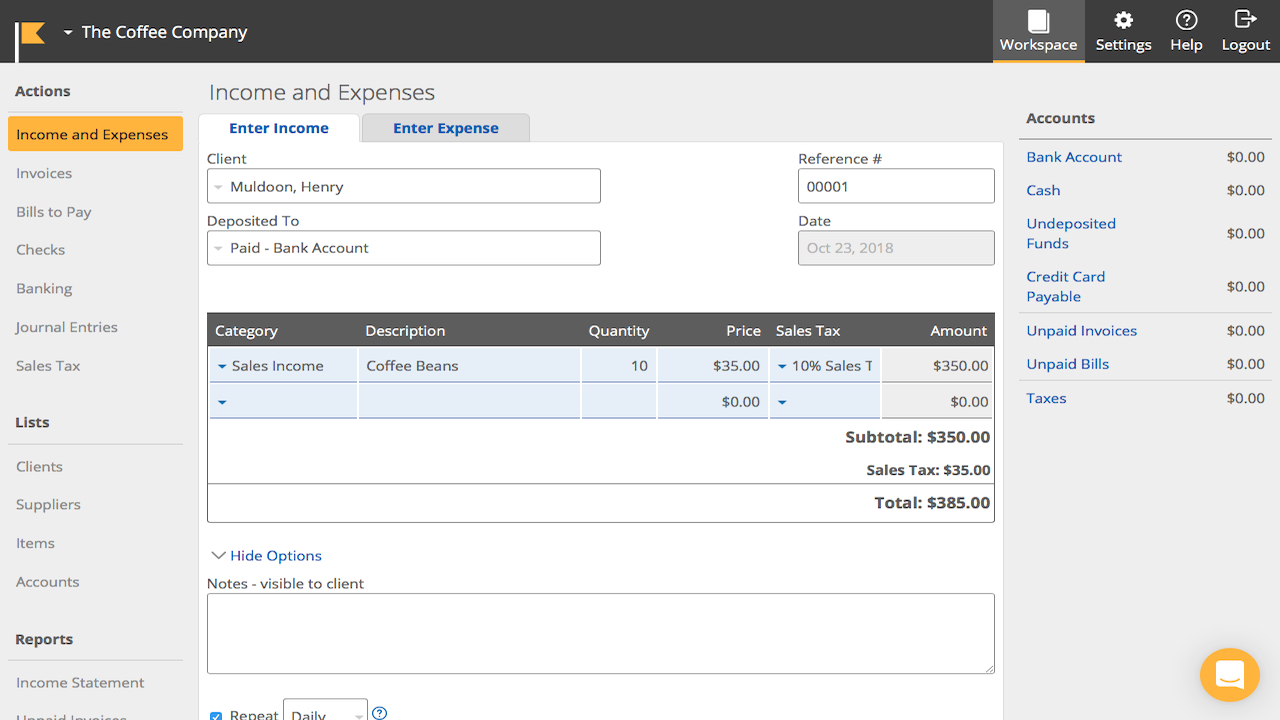

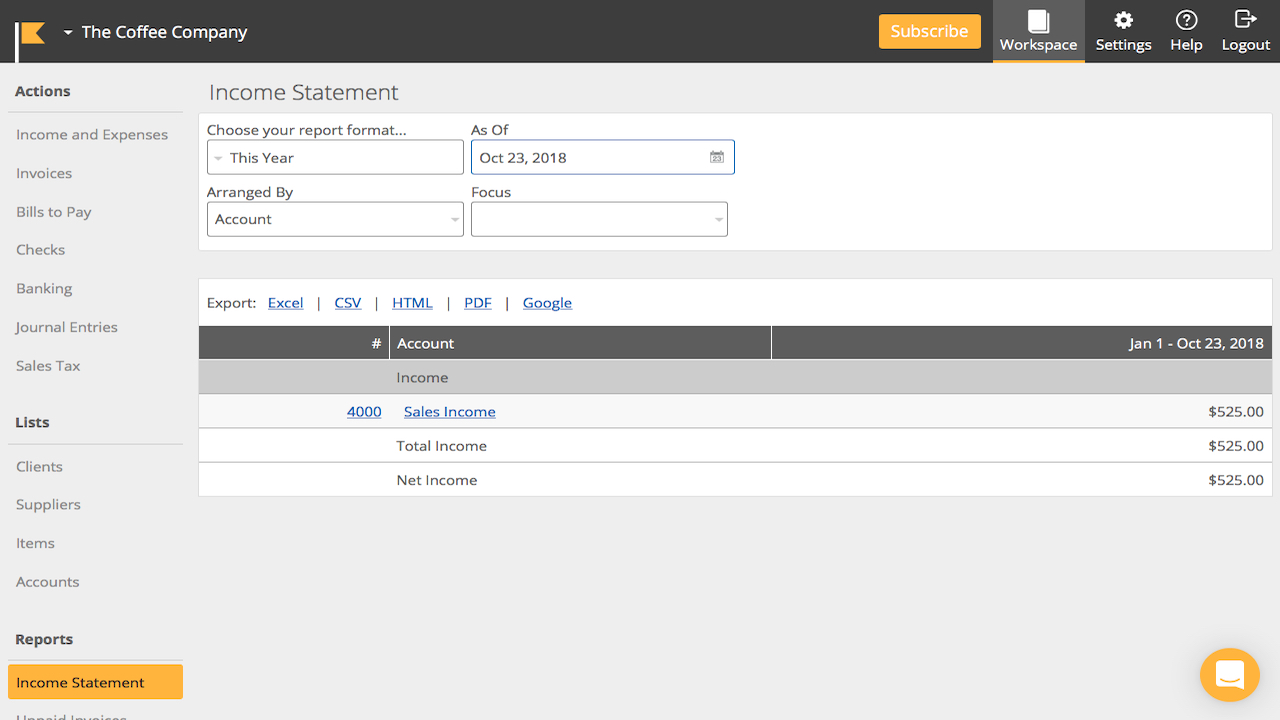

The dashboard, or ‘Workspace’ is very simply laid out. Most platforms show a generic financial overview by default. Kashoo, however, shows a detailed breakdown of income and expenses. You can enter a client into either ‘income’ or ‘expenses’. Payments made from particular clients are shown on the right-hand side of the page.

Files can be exported in either Excel or CSV format.

Use the left-hand side of the dashboard to access invoices, checks, banking, journal entries, sales tax, clients, suppliers, items and accounts.

Support is available via the ‘Help’ section on the top right of the page. There are dozens of support articles available in the Kashoo Helo Centre. if you can’t find the answer you are looking for in the documentation provided, you can use the online chat. We submitted a query to the chat team and received a response in 2 minutes.

Supported languages are English, French, Japanese and Spanish.

Invoices

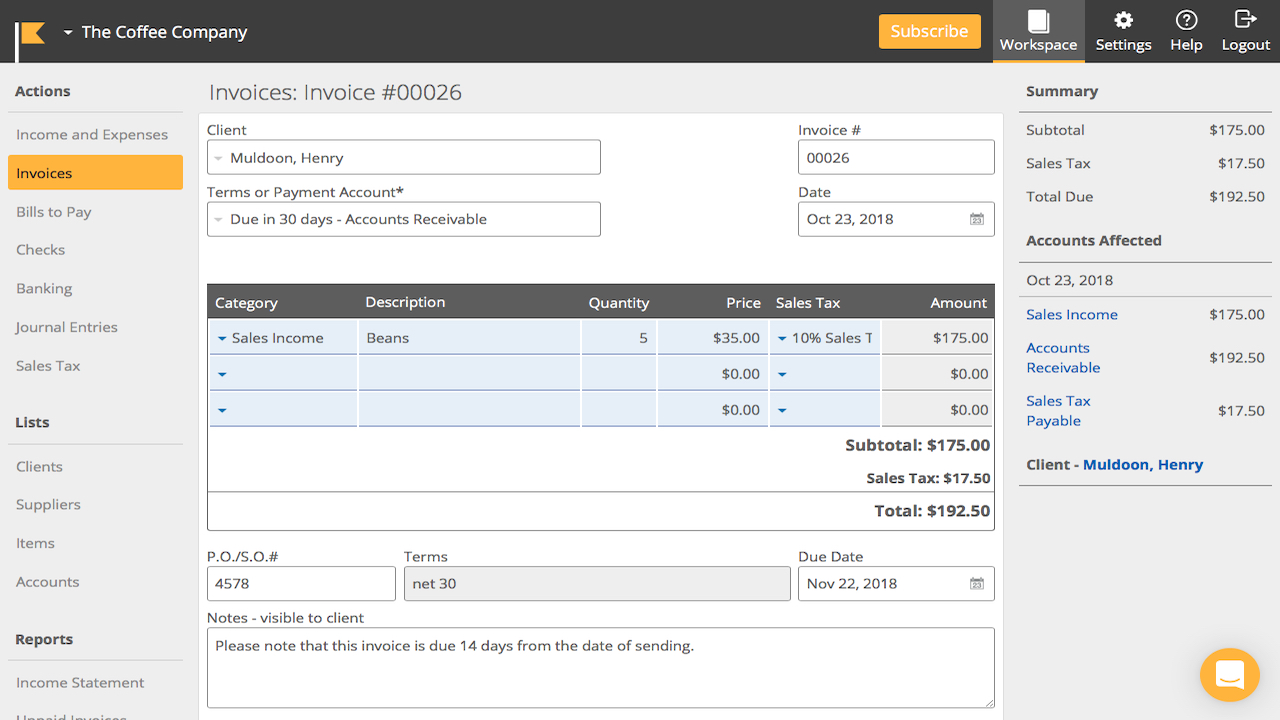

As with everything else on Kashoo, the invoice feature is simplistic in design. You just need to select the ‘Invoice’ tab on the left of the screen in order to start working on a new invoice. From here, you can enter a payment, submit a new invoice or enable credit cards. The left-hand side of the screen displays your current profit, unpaid invoices, income by client and account.

You can enter the client name and number on each invoice as well as invoice number, date sent, date due, bill category, description, quantity sold, sales tax and the total amount. You can also add a note to the client at the bottom of each invoice.

While invoices offered by Kashoo may not be as aesthetically pleasing like the ones available from FreshBooks, they offer exactly what most users would expect to see on an invoice template.

Reports

Kashoo offers a number of different types of reports. You can choose from these on the left-hand side of the screen. These include income statements, unpaid invoices, trial balance, balance sheet, a general ledger, all transactions and history. While this list is not as extensive as that offered by GoDaddy Bookkeeping, it does have a few options not available from its competitors.

These can all be exported in PDF, CSV, Excel and Google formats. Each report can be filtered by date, project, client or supplier. You can also view comparisons such as month-to-month and year-to-year.

Features

Kashoo doesn’t have its own payroll system. However, it does integrate with SurePayroll. You can enable this via the add-on section at the bottom left of the dashboard. Prices start from $54.99 for 10 users per month. Once you fill in your company details, SurePayroll will calculate your monthly costs.

Kashoo offers a mobile app to subscribers: it’s available for iOS only. Users must have iOS 9.3 or later installed. The app supports iPhone, iPad and iPod touch.

The mobile app doesn’t not offer the same variety of functions as the desktop version. However, you can take pictures of expenses and upload them to your account. The app can also display financial reports, invoices and expenses.

Final verdict

Kashoo is excellent value for money for small business owners. They have dispensed with the many tiered pricing which most other platforms offer. Instead you get access to everything they offer for one monthly or annual commitment.

The platform is easy to use and tracks all payments received by your business as well any bills and expenses accrued. Unlike its competitor, Wave Accounting, it doesn’t offer automatic payment reminders. It is a ‘no muss, no fuss’ solution for users who want a simple accounting solution. It may come with no frills but this makes it easier to navigate and there is little to no learning curve.

- Also check out the best personal finance software

0 comments:

Post a Comment