eToro crypto exchange and trading platform

eToro is an all-in-one trading platform that allows users to dabble in currencies, commodities, stocks, and cryptocurrencies. Based in Israel, eToro boasts of millions of clients in over 100 countries.

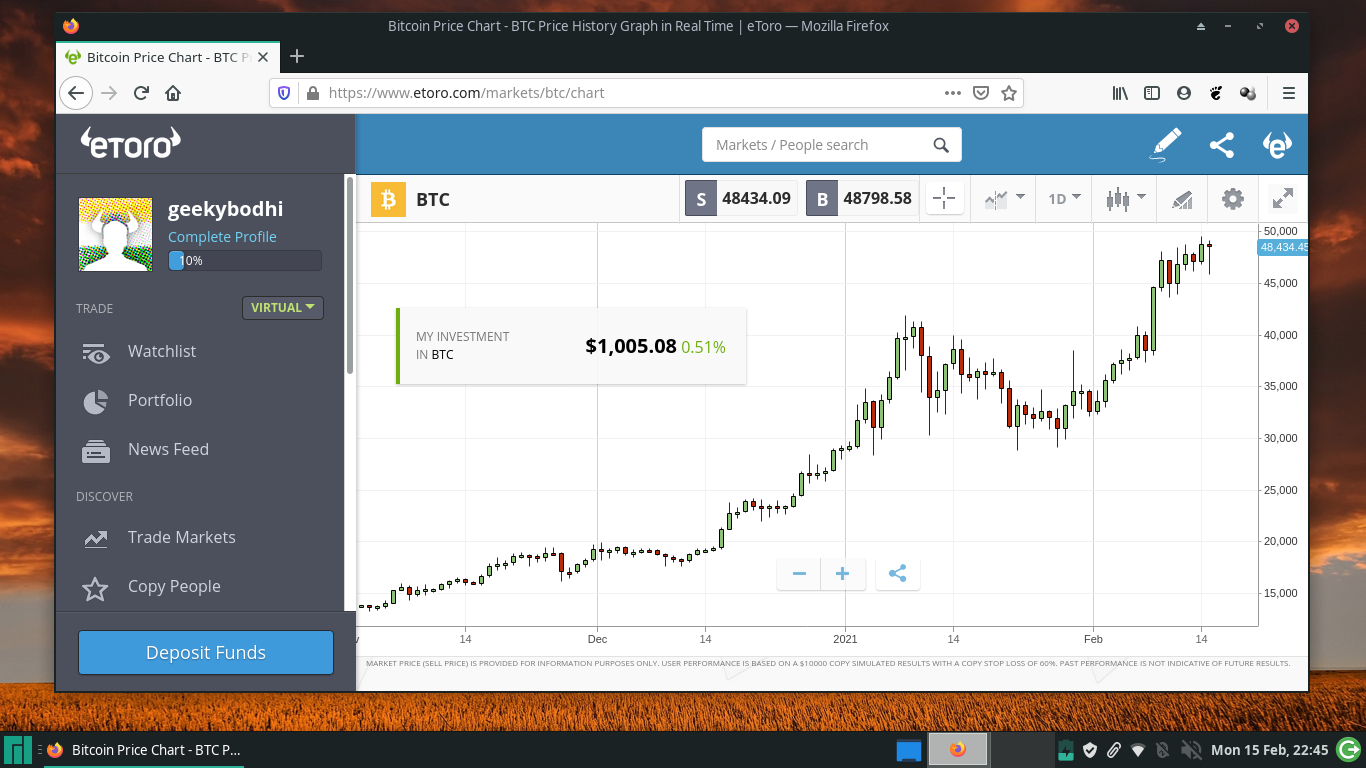

The platform first introduced Bitcoin trading in 2013, but has since become a more well-rounded exchange that offers various cryptocurrency products.

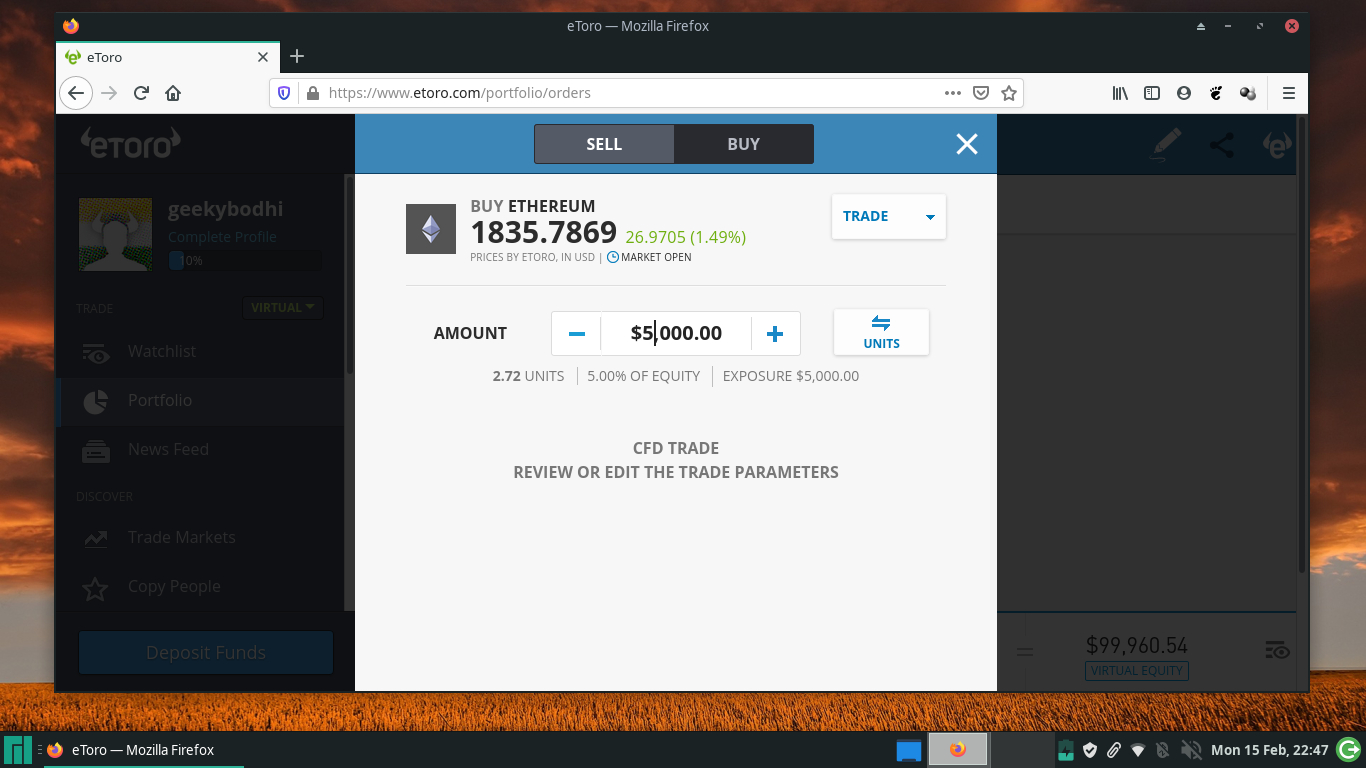

Broadly speaking, eToro offers two mechanisms for investing in crypto. You can either buy crypto with no leverage, in which case the underlying asset is held in cold storage by eToro on your behalf. Or, you can trade crypto via a Contract for Difference (CFD), whereby you don’t own the underlying asset but rather speculate on its future price.

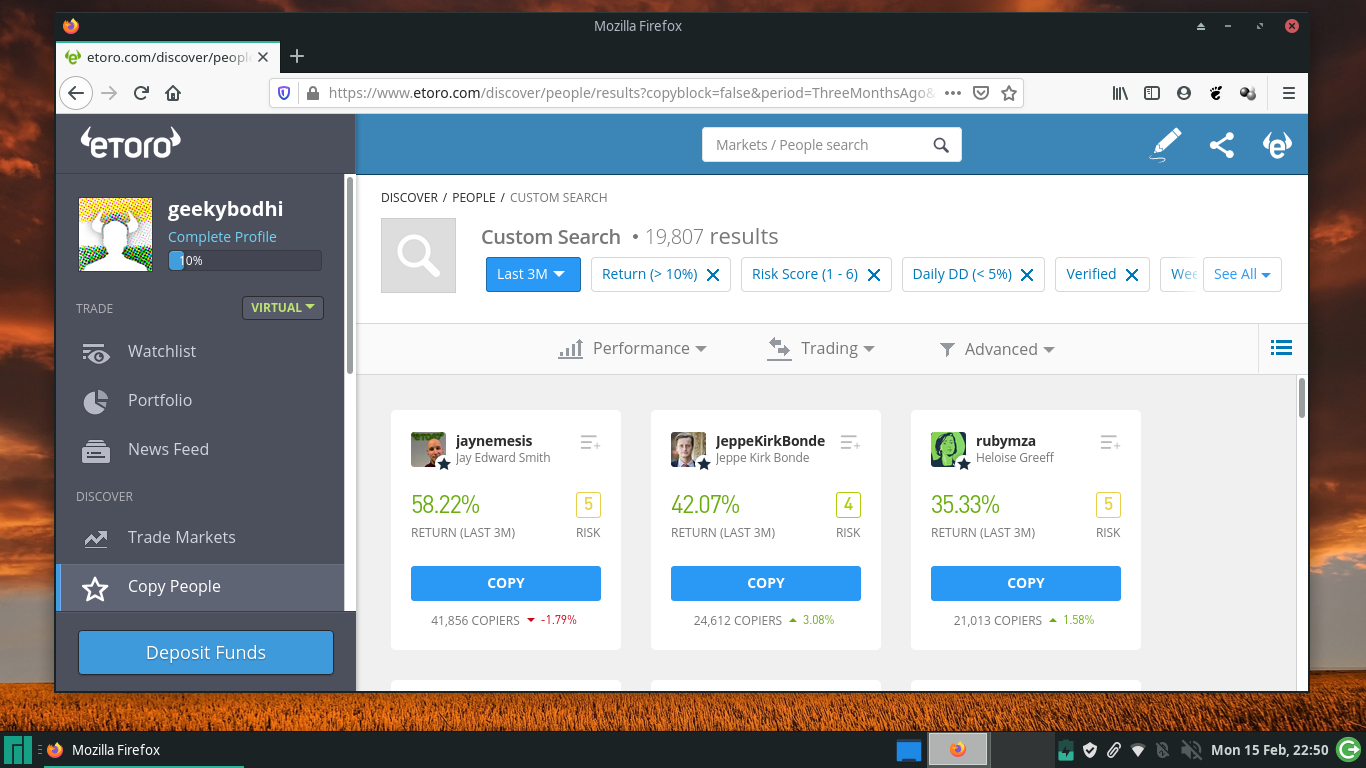

One aspect that makes eToro stand out is that it is offers social trading facilities. Using the platform's copy-trading feature, for example, users can follow and copy the positions of other traders.

But does that make it a good option for trading crypto?

Fees

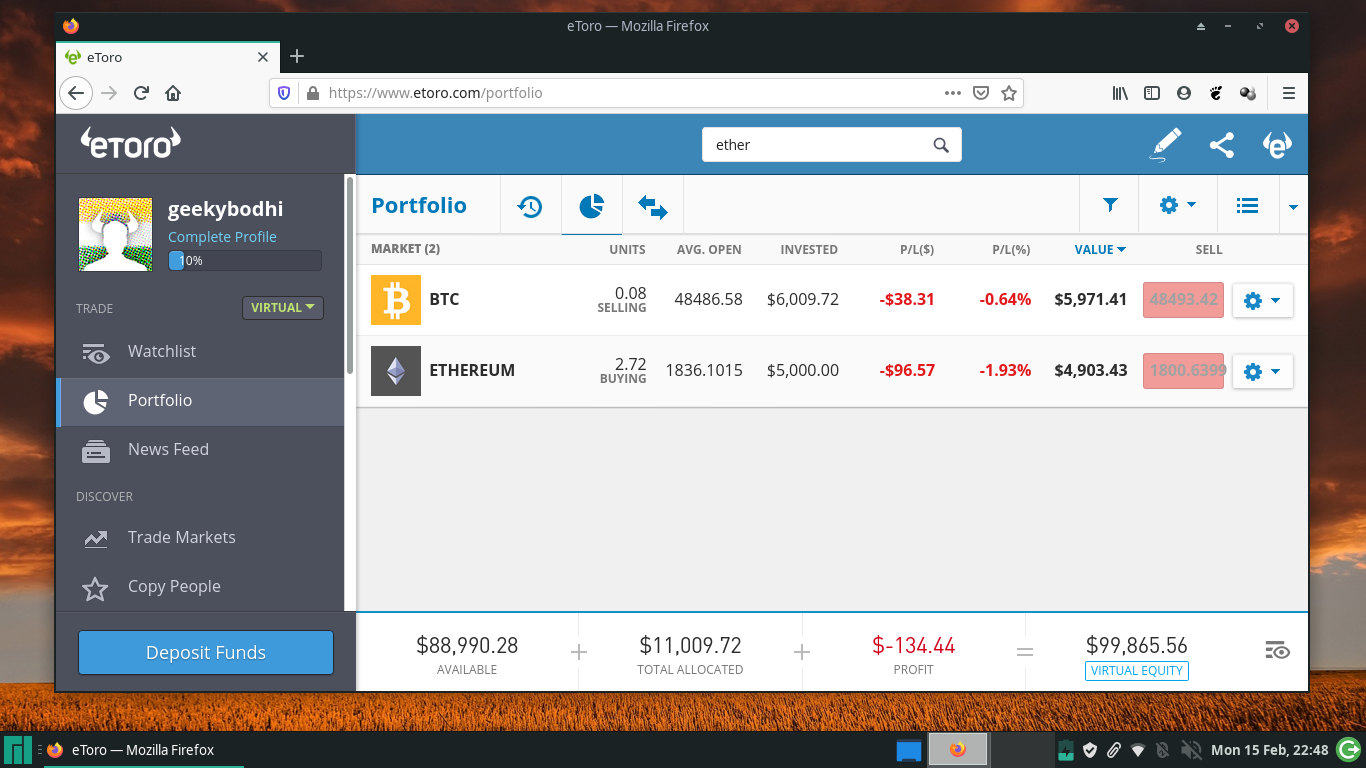

There are no fees for joining eToro and registered users can also make use of a free practice account, which comes stocked with a pretend balance of $100,000.

However, like virtually all its peers, eToro charges various spreads on trades and fees for facilities such as withdrawals.

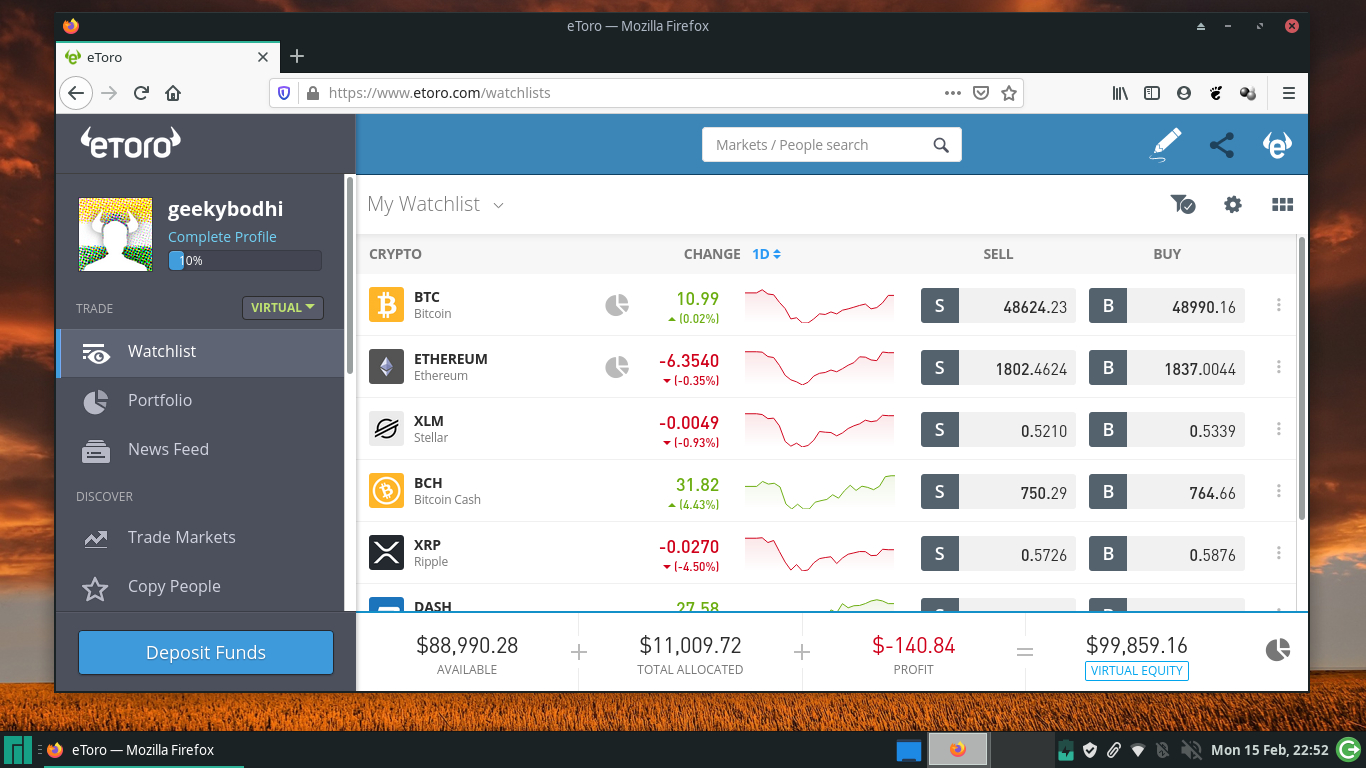

Since it offers multiple trading platforms and instruments, eToro’s fee structure is rather complex. For cryptocurrencies, the fee varies for different coins. For instance, the spread on Bitcoin is 0.75%, 1.90% on Ethereum and a massive 5% on Tezos.

One of eToro’s unique products is its CryptoPortfolio, which allows you to invest in several popular cryptocurrencies in one go. Weights are distributed according to the percentage of each crypto’s market cap within the total market cap of all cryptocurrencies. There are no fees for investing in CryptoPortfolio, but the minimum investment required is a whopping $5,000.

Further, there’s also a withdrawal fee of $5 for cashing out your profits and the minimum withdrawal amount is $30.

Interface and ease of use

The sign-up process for eToro is pretty straightforward. After that, you’ll have to complete your profile to lift deposit limits. Since eToro is a regulated platform, as part of the profile you’ll have to provide identification information based on your country of residence, in accordance with standard know your customer (KYC) requirements.

While you can explore most of the interface, some functions, like research information about cryptocurrencies, are only available to paying users.

The platform offers several options for depositing money into your eToro account. The minimum deposit amount for US users using online banking is $50, both for first-time deposits and redeposits, while for deposits made by wire transfer, the minimum is $500.

With eToro you can currently trade over two dozen cryptocurrencies, including Bitcoin, Ether, Ripple, Litecoin, Dash, Tezos, and other altcoins. The interface is fairly intuitive and won't pose any issues for experienced traders.

eToro also offers its own wallet and users in Europe and UK can transfer long positions that are backed by real crypto into it. The transfer incurs a fee that depends on the cryptocurrency, along with a minimum amount. For instance, you can transfer a minimum of 0.008 BTC to the wallet and it’ll cost you 0.0005 BTC. For Ether, the minimum is 0.26 ETH and costs 0.006 ETH.

Note, however, that wallet transfers are subject to manual review and can take up to five business days to complete. But once in your wallet, you can send your crypto to an external on-chain wallet via a straightforward interface.

Security

Despite the fact that eToro has been in operation since 2007, and is available across several geographies, the platform hasn’t suffered any notable security breaches.

In July 2020, it was reported that hackers had put up details of several thousand eToro users for sale on the dark web. While it was claimed that several users reported “unusual activity” in their accounts, there weren’t any reports of users actually losing money or access to their accounts.

In January 2021, eToro was accused of closing leveraged positions extended via its CFD facility, due to what the platform referred to as “extreme market volatility in the crypto markets”. The CFD function is available only to European users of the platform outside of the UK.

Support

eToro has an extensive support infrastructure. Unlike many of its peers, it offers a free demo account that allows users to practice trading.

It’s also got an extensive, searchable help center, which has a good collection of articles that answers common questions about all of popular eToro products and services. On the platform’s website you’ll also find several educational resources designed to teach the craft to first-time traders through courses, webinars, videos, podcasts, and written documentation on a variety of relevant topics and skills.

If you are stuck and the online help resources can’t find you an answer, you can bring the issue to eToro’s customer service team by raising a ticket. For a speedier response, you can also chat with an online representative.

Bigger traders with account balances of over $5000 are enrolled in the eToro Club’s tiered membership, and among other benefits are assigned a dedicated account manager.

Alternatives

eToro offers multiple options and sits somewhere between pure exchanges like Coinbase and trading platforms such as SoFi Invest and Robinhood.

In terms of trading crypto, you use fiat to buy and trade digital currencies, pretty much like on other trading platforms. However, eToro offers a larger number of tradable cryptos and is available in more geographies than many of its peers.

Also, unlike SoFi and Robinhood, you can transfer your non-leveraged crypto from the trading platform to the eToro hot crypto wallet, from where you can transfer the crypto to any other non-custodial on-chain wallet.

You can even move the crypto to the eToroX exchange, where you can trade it with other cryptocurrencies.

To top it all off, eToro offers a couple of unique trading products, namely CFDs and copy-trading, that you won’t find with most peers.

Final verdict

If you set aside eToro’s complex fee structure, the platform outperforms most of its peers in terms of functionalities. It also offers social investment features, unlike other services on the market.

While transactions on eToro can be expensive, we would still recommend the service to anyone interested in trading cryptocurrencies, because the trading practice option allows users to hone their skills before real money comes into play.

0 comments:

Post a Comment