Bill.com

Paper checks have persisted as a common way for businesses to receive payments. While in North America these checks dominated at 81% of transactions as recently as 2004, by 2019 these checks have dropped to 42% according to CTMFile. Driving this trend has been a move towards electronic transfers, with the pros of less fraud, faster payments, and also less physical mail and contact with COVID-19.

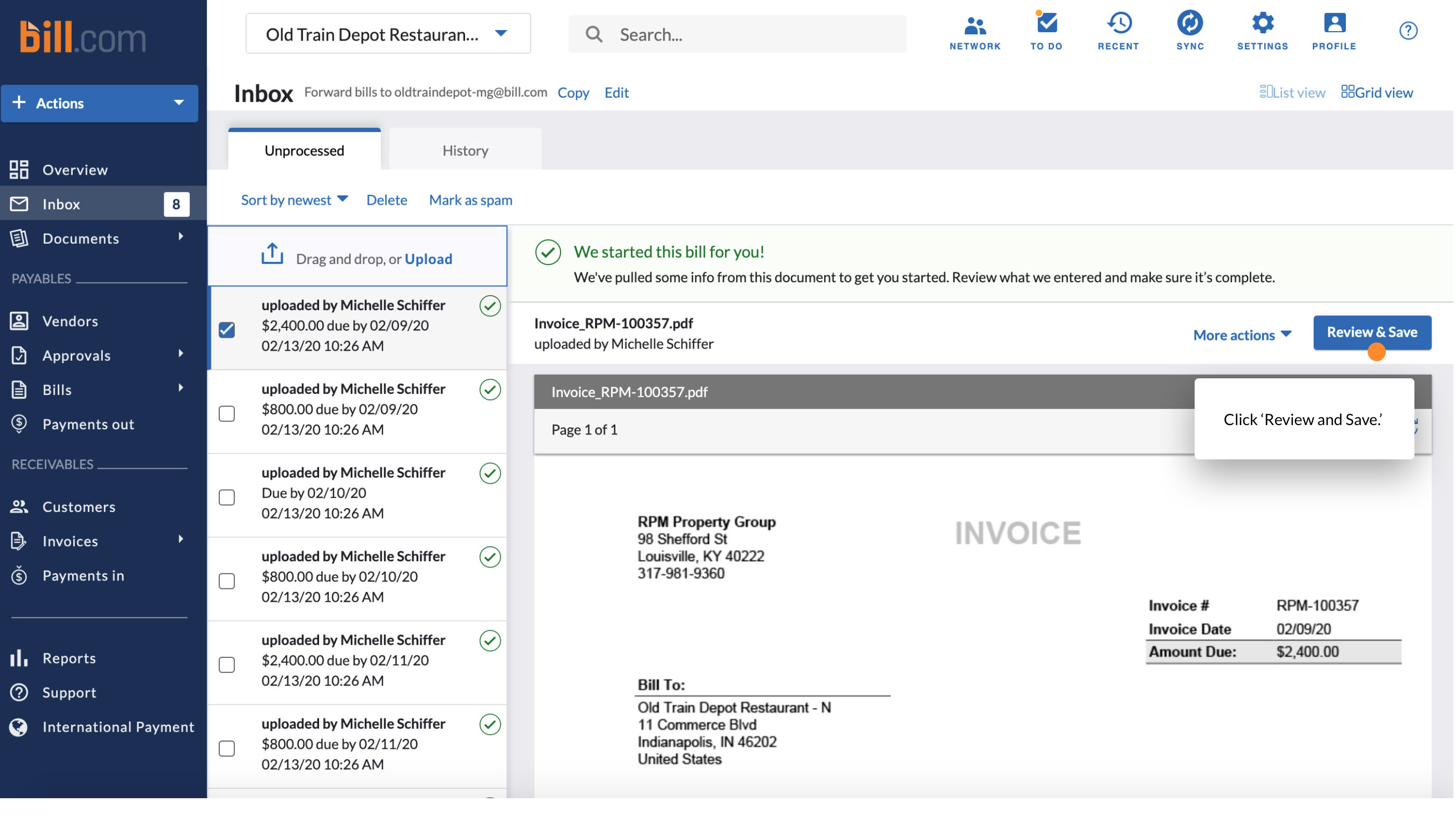

Riding this trend towards digital payments is Bill.com, a cloud based provider of software that “Simplifies, digitizes, and automates back-office financial processes for small and mid-sized businesses.” Its stated mission is to enhance payment workflows, streamline processes, and make receiving payments more efficient. Notable clients of Bill.com include GrowthForce, Mercari, and Quicken that are among the over 2.5 million companies that use the service.

Plans and pricing

Businesses that want to use the Bill.com platform sign up via a monthly subscription. It gets confusing fairly quickly, but first you need to choose whether you want to get paid, pay bills or both. Then, under each scenario there is a choice of two tiers. We are going to ding Bill.com for dividing up the getting paid, and paying bills into two different plans, as many companies will want to do both, and this strategy forces them into the more expensive plans.

Let’s take a closer look at the “Get paid” offering, which is designed for a business to send invoices, and receive payments back. There is a lower tier, designated as Essentials, and it offers payment status tracking, ACH and credit card payments, and automated email reminders among its features, at a cost of $39/user/month. Then there is an upper tier plan, called Team, that has the same features, and also adds integration with QuickBooks Online, QuickBooks Pro/Premier, and Xero; this plan costs $49/user/month.

There is also a Pay Bills plan, which is priced analogously with a lower Essentials plan at $39/user/month, and the better Team plan that goes up to $49/user/month to add in the integration with the same financial software products.

For a business that needs to both pay bills and receive payments, there is a plan that combines both. This plan, called Corporate, has a cost of $69/user/month, and also integrates with other financial software. There is also custom pricing available, with additional features, such as a single sign on, and API access.

Features

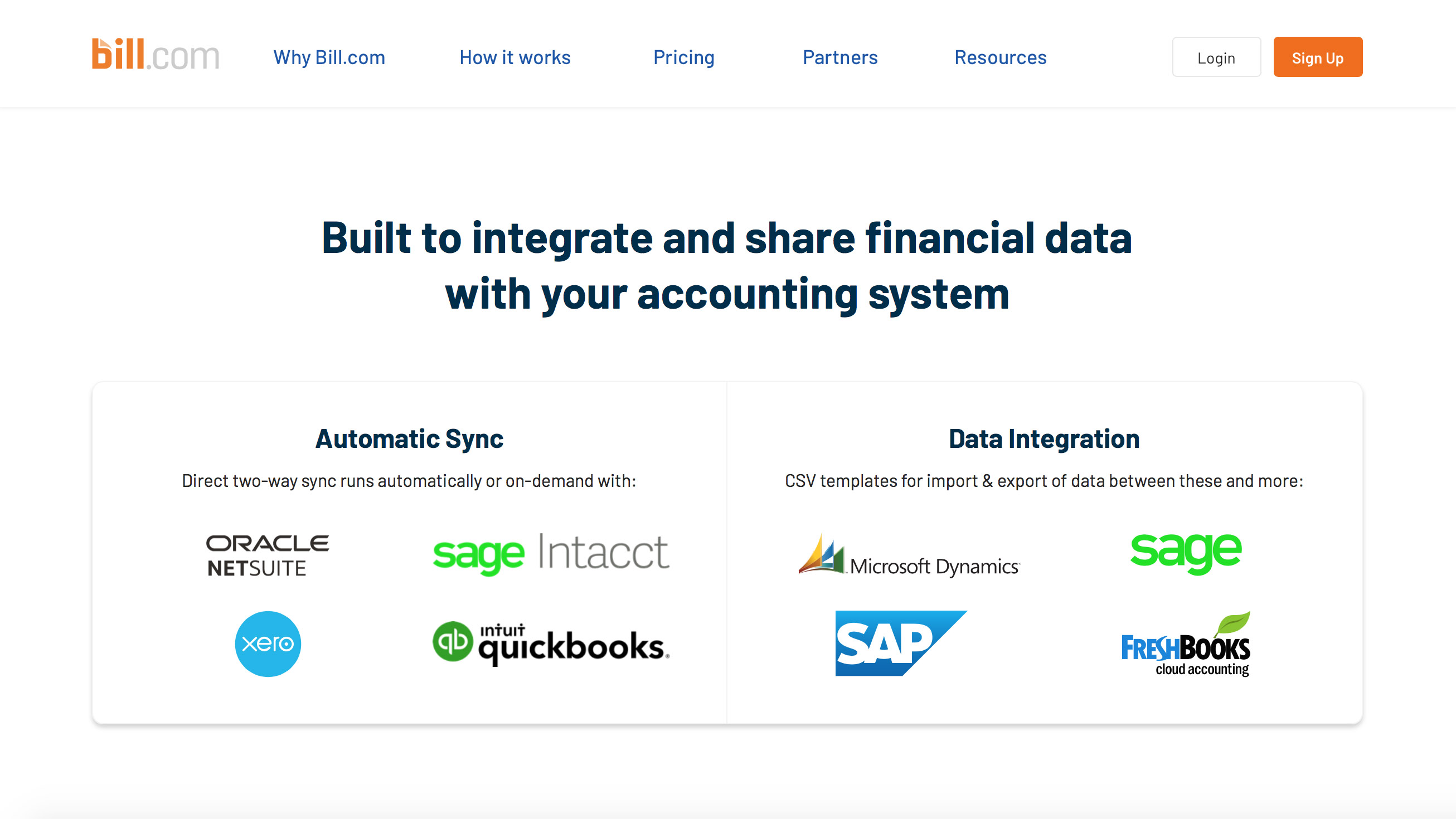

Bill.com is a secure financial platform that is designed to both receive payments on invoices, and to send payments. It can be integrated, at an additional cost, with financial software, such as Microsoft Dynamics, Oracle NetSuite, and QuickBooks.

We like the flexibility of the platform, as it supports payments via a number of methods. This includes options such as paying vendors with a credit card, cost effective international payments, and the popular ACH (Automated Clearinghouse) that allows payments to move faster.

Support

The support for Bill.com is a mixed affair. We are disappointed to not find a direct phone number for support, as this is the ideal way to resolve a complicated situation in real time. We also did not find a direct email address, nor a support portal.

The most direct support we could fund is a chat box. It also has limited hours of operation, from 5 AM to 6 PM on Monday to Friday only.

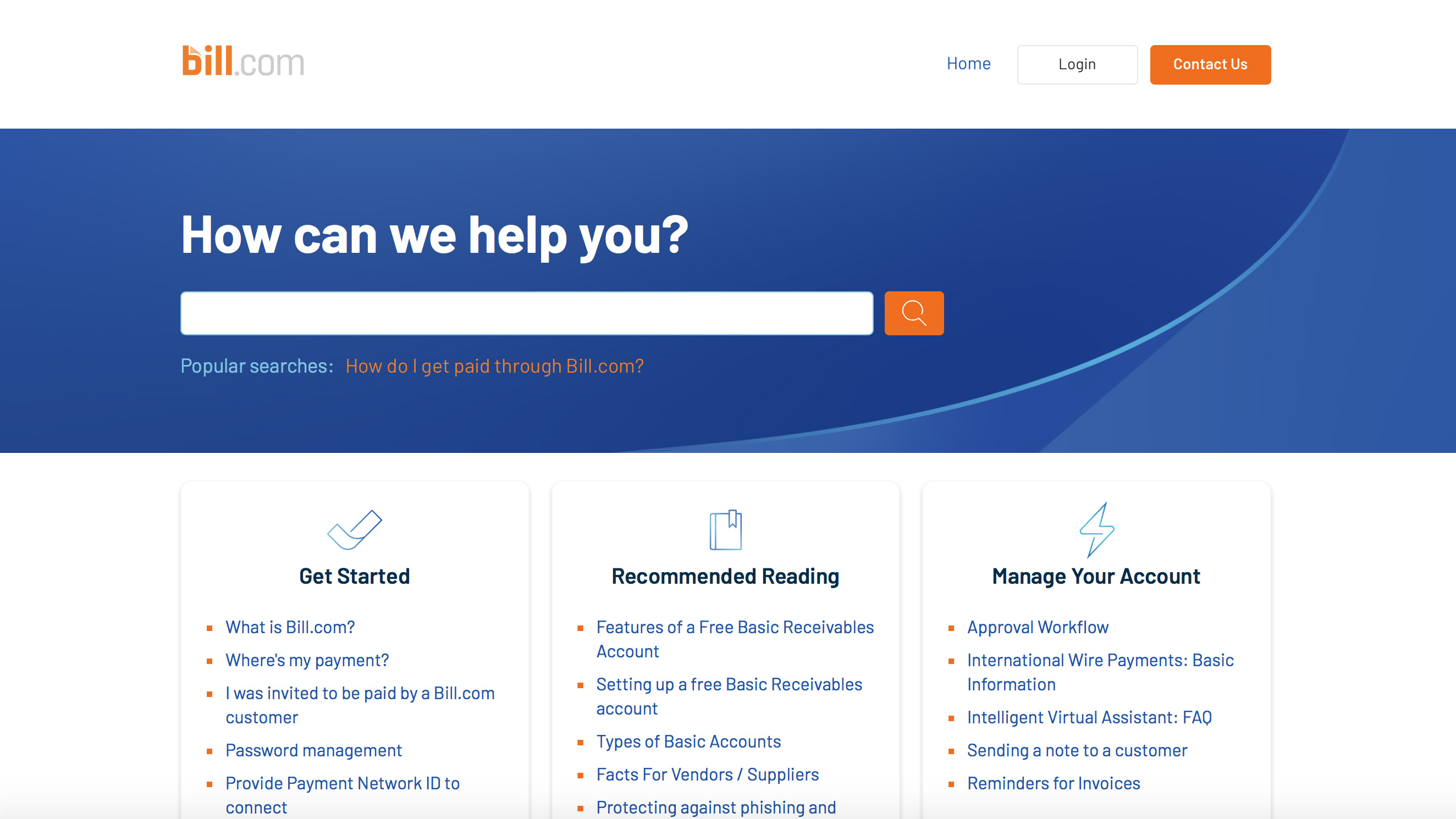

Moving to the self help support options, we did find a decent knowledge base. It organizes answers to questions into three content areas. For example, under the Get Started category, among the topics is “I was invited to be paid by a Bill.com customer.”

We also did find multiple other options, such as webinars, a blog, help videos, and whitepapers. However, they take some additional looking (hint: check out the options at the bottom of the home page), as they are not front and center on the knowledge base page.

Final verdict

Bill.com gets plenty of the basics right, with the many options for self help, such as videos, the integration with financial software, and the choice of plans, along with two tiers to choose from within the plan. However, we found the cost to be high as it is by each user, and are perturbed that the lower plans can only send or receive money- and not both, pushing folks into the top plan for the basic functionality that we would think that most businesses expect. That said, the service is still worth checking out for those businesses that need to streamline their payment and invoicing process.

We've also highlighted the best accounting software

0 comments:

Post a Comment